Gold Rush 2.0: Why Smart Money Is Grabbing Physical Gold—And What It Means for You

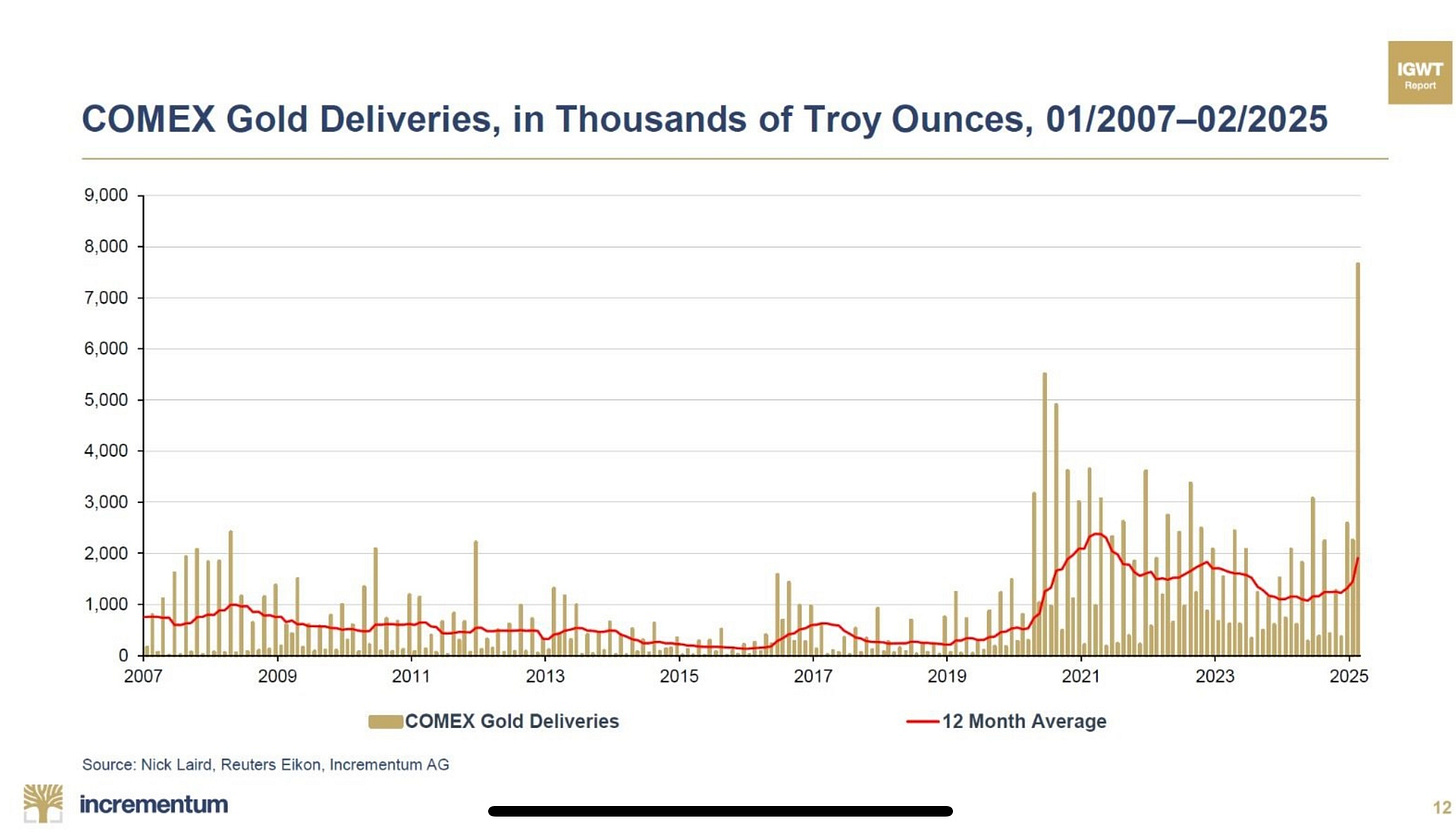

COMEX gold deliveries are soaring. Are we witnessing the start of a new financial crisis hedge? Here’s what’s happening and how you can prepare.

Gold isn’t supposed to be exciting. It’s the old-world store of value—steady, reliable, and, let’s be honest, kind of boring compared to crypto, AI stocks, or meme-driven market frenzies.

But something very interesting is happening in the gold market right now, and if you care about preserving your wealth, you need to pay attention.

COMEX, the world’s biggest futures exchange for gold, is seeing an explosion in physical gold deliveries. This means investors aren’t just trading contracts that track the price of gold—they’re demanding the real thing, in their hands, now.

This isn’t normal. It’s a sign that the big players—hedge funds, institutions, and high-net-worth individuals—are nervous. And when smart money starts scrambling for physical gold, it’s time to ask: What do they know that we don’t?

Let’s break it down.

What’s Happening on COMEX?

Typically, COMEX operates as a paper market for gold. Traders buy and sell futures contracts, making bets on where the price of gold is headed without actually touching a single gold bar. The vast majority of these contracts never result in the delivery of physical metal—investors just cash out or roll over their contracts before they expire.

But that’s changing.

Recent data shows a massive spike in COMEX gold deliveries. This means more investors are opting to take actual possession of the metal rather than settle in cash. And when you look at the numbers, it’s eye-opening:

In just a few months, deliveries have jumped to levels we haven’t seen in years.

Large financial institutions and sovereign players are among the biggest takers.

Inventories in COMEX vaults are declining as metal is being withdrawn.

Translation? The demand for real, hard gold is outpacing what COMEX can easily supply.

This shift isn’t just a blip—it signals a deeper concern about the financial system, inflation, and trust in fiat currency.

Why Are Investors Grabbing Physical Gold?

To understand why this is happening, we need to look at the bigger picture. The world is sitting on a financial powder keg, and the signs are everywhere:

1. Inflation Is Quietly Eating Your Wealth

Central banks have spent the last few years printing money at an unprecedented rate. While inflation has cooled from its peak, prices haven’t come down. Your dollars (or loonies) still buy less than they did a few years ago. Gold, historically, has been a go-to hedge against this erosion of purchasing power.

2. Debt Levels Are Unsustainable

Governments around the world, including Canada and the U.S., are drowning in debt. When debt reaches unsustainable levels, central banks have two options: raise rates (which risks collapsing the economy) or print more money (which devalues the currency). Neither is great for your savings, but both tend to push gold prices higher.

3. Bank Failures & Economic Uncertainty

Remember the bank collapses of 2023? That wasn’t a one-off event. Banks are still under pressure, and trust in the financial system remains fragile. Institutional investors want to hold assets that don’t rely on counterparty trust. That’s why they’re opting for physical gold instead of just paper contracts.

4. Geopolitical Tensions Are Rising

From U.S.-China tensions to conflicts in Eastern Europe and the Middle East, geopolitical instability is another driver of gold demand. When things get shaky, gold shines.

What This Means for You

So, should you start hoarding gold bars under your mattress? Probably not. But you should take this trend seriously and consider what it means for your portfolio.

1. Gold’s Role in Your Portfolio Is More Important Than Ever

Smart investors allocate at least a portion of their portfolio to gold—not as a speculation play but as an insurance policy. A common rule of thumb is 5-10% in precious metals to hedge against economic shocks.

2. Gold Miners Could See a Major Boom

If physical demand continues to rise, mining stocks could benefit in a big way. Look at well-managed gold producers with solid balance sheets and low production costs. Juniors with proven reserves could also see upside.

3. Owning Physical Gold is Worth Considering

With growing concerns about counterparty risk, some investors prefer to hold actual gold rather than just ETFs or mining stocks. Options include:

Gold bullion or coins: Held in a secure location (not your sock drawer).

Allocated gold accounts: Stored in vaults but legally owned by you.

Gold-backed ETFs: An easier way to gain exposure, though you don’t actually own the metal.

Final Thoughts: Is This the Start of a Gold Supercycle?

No one has a crystal ball, but the signs are clear—gold demand is surging, and the world’s biggest financial players are positioning themselves accordingly.

For the average investor, the takeaway is simple: Don’t ignore this trend. The same forces driving big institutions to accumulate gold—currency debasement, economic instability, and geopolitical risks—impact your savings, too.

The window to buy gold at relatively low prices may not stay open for long. If you’re looking for ways to protect and grow your wealth, now might be the time to take a serious look at how gold fits into your financial strategy.

Stay ahead. Stay informed. And, most importantly, stay prepared.

What’s your take? Are you adding gold to your portfolio, or do you think this is just another hype cycle? Let me know in the comments!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with a financial advisor before making investment decisions.