Markets Are Down Again in Early Trading But is it Time to Move?

Your Tactical ETF Playbook Just Got an Update

Inflation’s down. Growth is sputtering. And your portfolio? It's due for a check-in.

Average investors often struggle with one of the trickiest parts of investing: when to make a move — and when to sit tight. There’s no shortage of noise out there telling you to buy the dip, sell the rip, chase performance, or sit in cash. But chasing headlines doesn’t build long-term wealth. Following a process does.

And so far our process is up on the year - the Tactical Growth and Income portfolio is up 1.98% while the Tactical Income portfolio is up slightly by 0.15%

This article walks you through how to adjust your ETF portfolio tactically — using real data, not guesses — so you stay aligned with where the economy is actually heading.

Let’s break it down.

📉 “We're Not in Kansas Anymore”: Welcome to Quadrant 3

The data is clear — we’re still in Quadrant 3, the economic phase marked by falling inflation and falling growth. That’s a unique combo, and it calls for a disciplined investment approach.

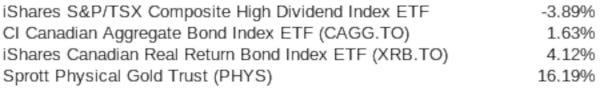

Let’s take a quick look at how key assets have performed year-to-date:

That’s not a typo — gold is up over 16%, while high-dividend Canadian equities are down nearly 4%. Bonds are hanging in there, especially real return bonds, which are quietly outperforming the traditional bond market.

This divergence tells us something important: markets are bracing for a slowdown. Inflation indicators — from oil prices to the inverted yield curve — suggest cooling prices ahead. Just look at the last year for oil prices!

And the growth picture? It’s not looking much better. U.S. unemployment is ticking higher at 4.2%, and recent job numbers are likely to be revised down due to data quirks.

Put simply: the slowdown isn't “priced in” — it's gathering momentum.

🛠️ “Set It, But Don’t Forget It”: Tactical Portfolio Moves

So what does this mean for your money?

We’re looking at this from the lens of two portfolios: Tactical Growth & Income and Tactical Income. Each one reacts differently in this macro environment — so let’s go one at a time.