Yesterday's Rally Faded Fast… Should You Be Worried?

Oil, Copper, and Gold Are Quietly Hinting at What Comes Next for Markets

What Just Happened… and Why It Might Matter More Than You Think

Markets opened strong today — the S&P 500 jumped more than 1.5% out of the gate. By lunchtime, the headlines were glowing. Another bounce, another “bottom,” right?

But by the afternoon? That surge fizzled. The market couyld not hang onto it’s gains.

If you're wondering whether this is just another head fake or the start of something real, you’re not alone. Fortunately, there are clues — and they’re not found in earnings reports or analyst notes.

They’re in the commodity markets.

Oil. Copper. Gold.

These aren’t just raw materials — they’re signals. The best investors don’t just follow the markets — they listen to what the markets are trying to say.

Keep reading — by the end of this article, you’ll know which ones to watch, and what they’re saying about what might come next.

🛢️ Oil: The Economy’s Blood Pressure Is Dropping Fast

Oil prices have quietly collapsed 33% over the past year.

That’s not just some headline stat — that’s the market telling us something serious about demand.

Energy is the lifeblood of the global economy. Planes, trucks, cargo ships, factories, food supply chains — they all run on energy. When oil prices fall this much, it’s not just a supply issue. It’s a signal that demand is weakening.

Even more concerning: oil is now trading below the cost of production in many parts of the world. That’s not sustainable, and it suggests producers are bracing for tougher times — or they’re being forced to sell at a loss just to survive.

It doesn’t take an economist to figure out what that might mean for earnings, job growth, and eventually… the stock market.

🧱 Copper: The Real Estate Canary in the Coal Mine

Next up: copper.

Like oil, copper is quietly sending signals that don’t match the market’s upbeat tone. Prices are down 20% from recent highs — not a mild correction, but a meaningful move.

Why does that matter?

Copper is used everywhere: wiring, plumbing, construction, infrastructure, electronics. If copper demand is falling, it’s usually because new building projects are slowing, home construction is cooling, or industrial production is taking a hit.

In short: a weak copper market means less building, less growth, and fewer signs of economic strength.

This is the stuff the headlines won’t tell you — because it’s not sexy. But it matters. Copper is often called “Dr. Copper” for a reason: it’s a leading indicator of economic health.

Right now, the doctor isn’t optimistic.

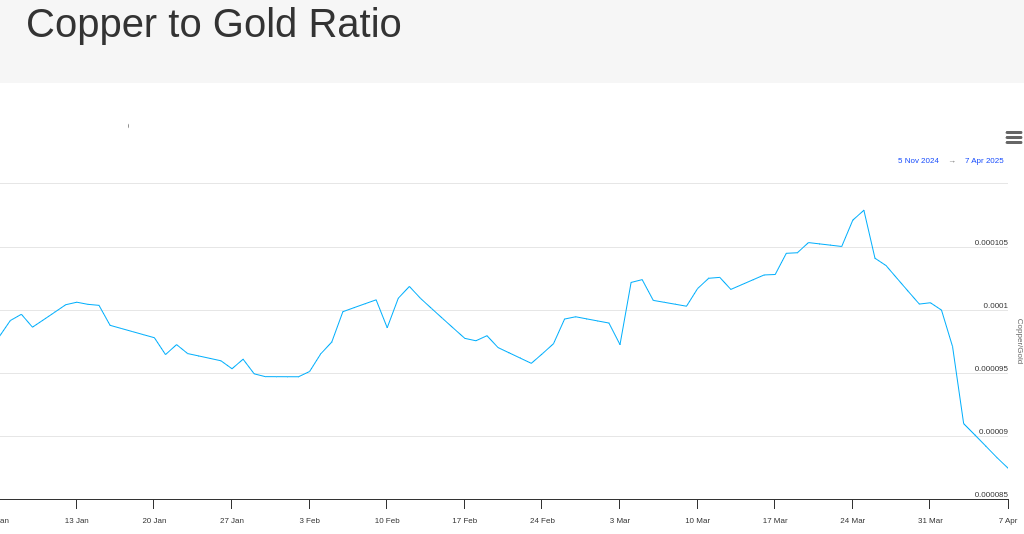

⚖️ The Copper-to-Gold Ratio: Fear Is Winning

There’s one more signal worth watching — and it’s the one that ties everything together: the copper-to-gold ratio.

This ratio compares the price of copper (a risk-on, growth-linked commodity) to gold (a fear-driven, safety play). When the ratio is rising, markets are optimistic. When it’s falling, investors are nervous — or worse, scared.

Right now, it’s falling. Steadily.

In fact, yesterday’s brief rally — which fizzled by the close — was a textbook example of a fear-dominated market. Investors wanted to believe in the bounce… but by the end of the day, they sold into strength, not with confidence but with caution.

The copper-to-gold ratio is whispering what the headlines won’t say out loud: this rally may not have legs. Fear is still winning.

So What’s the Takeaway?

Oil says demand is falling.

Copper says growth is slowing.

Gold says fear is in charge.

If you’re wondering whether this market bounce is the real deal or just another trap — commodities have already answered. And they’re not buying the optimism.

None of this means you need to panic or sell everything. But it does mean you should be cautious. Commodities are the heartbeat of the real economy. They don’t lie. They don’t hype. And right now, they’re flashing yellow — maybe even red.

Great opportunities will come, just don’t jump the gun and keep some powder dry.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with a financial advisor before making investment decisions.